by Danielle Benjamin

Financial planning often determines how we live and play after a successful career. My wish for all of you is a long and happy retirement. Part of that equation is our county pension, but we can all supplement that with preparation earlier in our careers.

I recall the beginning of my career, when retirement was so far from my mind. I was more concerned with making sure my kids went to bed with their teeth brushed. Fortunately, I had family that pounded retirement planning in my head.

Retirement looks different for each of us. Some are fortunate to have two pensions going into retirement. Most have a spouse without a pension. We all know others who have a former spouse (or two) who took part of their pension. Simply, the younger we are when we begin planning for our future retirement, the better off we will be. Although we have an amazing opportunity with a pension, it is in our best interest to supplement and diversify.

Some of our newer deputies have the mindset they need a career of well over 30 years. This is one reason it is important to know your benefits. With PEPRA, there is a max pension benefit which may actually negate working towards 100%. As of the 2020 calendar year, there is a cap on pensionable compensation of $126,291 for members who participate in Social Security, and a cap of $151,549 for members who do not. Both limits are subject to increases in the Consumer Price Index. It is imperative our younger members understand their retirement benefits so they can best prepare for the retirement of their dreams.

Many years ago, a financial planner made a presentation at a DSA meeting and I gave my information for further contact. That is when I met Trevor Issacs, now working with Eagle Strategies. I have learned a lot from Trevor, some of which I wish I knew earlier. Part of the lesson was diversification. I asked Trevor to give a little insight for this article, and he shared the below:

We all want to be prepared for the unexpected and to eliminate as much uncertainty, fear, and stress from our lives as possible—whether we’re just starting our career and family or well into retirement. Unfortunately, getting our financial house in order is something most people tend to procrastinate over and put off until later in life. With all the choices out there when it comes to investments to grow your assets and insurance to protect them, it’s difficult to know exactly what’s right for you because, after all, what’s right for one person or family is not always what’s right for another.

One of the biggest and most general questions I often encounter as a financial advisor is “How do I establish long-term financial security?” So, here are a few tips to get started depending at what stage of the game you are at:

- Understand that being a “saver” will put you in a much better financial position over your lifetime as opposed to being a “spender”. In other words, defer immediate gratification spending and set goals for accumulating cash to make major purchases. Once of the best places to save for retirement is inside your employer-sponsored, qualified retirement account such as a 457(b) or 401(k) plan. These tax-advantaged employee retirement plans can allow you to save through payroll deduction so the money comes right out of your paycheck before you even see it and in many cases will benefit from some sort of employer matching contribution.

- Balance between pre-tax and post-tax investing to make the most of your tax savings today and in the future. Often times people focus only on the immediate tax-deduction benefit available with pre-tax investing as you get from your 457(B) or 401(K) and forget that those dollars will be subject to ordinary income tax upon distribution when that time comes. By using a post-tax retirement tool like a Roth IRA, assets can accumulate and then be distributed tax-free helping to minimize your overall tax liability when it counts the most, in retirement.

- Use additional tools to help balance out investment risk as well as reduce risk such as cash value life insurance and Long-Term Care insurance, diversified stock and bond portfolios, real estate, and even precious metals like gold and silver. Making sure that you accumulate in multiple buckets will ensure you can lean in one direction or another depending on what the economic situation is.

—

I highly suggest you consult with a financial planner at several points in your career: beginning years (0-5 years), middle (10-15 years) and towards the end (20-25 years). Below you will find contact information for a few helpful sources:

Trevor Isaacs

trevor@izxfin.com

(858) 444-7670

www.izxfinancial.com

dsasd@facetwealth.com

(443) 376-6222

www.facetwealth.com

Hannah Zuilan

h.zuilan@nationwide.com

(619) 207-9163

www.mydcplan.com

Lastly, here is some helpful information from SDCERA’s website on the different tiers and retirement eligibility. Visit www.sdcera.org for more information. There are five Active Member Benefit Tiers:

- Tier I: Members who were hired before March 8, 2002 and have opted out of Tier A.

- Tier A: Members who were hired on or after March 8, 2002 and before August 28, 2009, and Tier I and Tier II Members who were converted to Tier A on March 8, 2002.

- Tier B: Members who were hired on or after August 28, 2009 and entered SDCERA Membership before January 1, 2013.

- Tier C: Safety Members who were hired on or after December 1, 2012 and before July 1, 2020. General Members who were hired on or after December 1, 2012 and before July 1, 2018.

- Tier D: Safety Members who were hired on or after July 1, 2020. General Members who were hired on or after July 1, 2018.

Retirement Benefit Formula

Your SDCERA retirement benefit is calculated using three factors: Age Factor x Service Credit x Final Average Compensation

1. Age at retirement

Your age at retirement is represented by an age factor—a percentage—that varies with age. Your age factor is based on the age you are on the first day you are retired (to the nearest completed quarter year). The maximum age factor depends on your Membership classification and tier.

2. Total service credit at the time of your retirement

Service credit measures the time earned as a Member of SDCERA while in paid status – in short, how long you have worked at your job following your entry into SDCERA Membership. One year of service credit is earned for each year of full-time employment. Working on a part-time basis results in a proportionwate amount of service credit. For example, a Member working 20 hours per week for one year will receive a half year of service credit. You may be eligible to purchase service credit, but the purchase must be completed prior to retirement.

3. Final average monthly compensation (based on your highest eligible earnings)

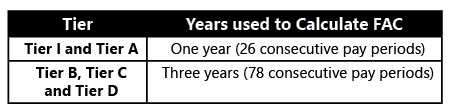

When you retire, SDCERA uses your highest final average compensation (FAC) to calculate your retirement benefit. The number of years used to calculate the average varies based on your tier.

For most Members, final average compensation is represented by their last year(s) of service because most Members earn their highest rate of pay at the end of their career. However, this is not always the case. SDCERA will always use a Member’s highest final average monthly compensation (up to the limit allowed by the Internal Revenue Code), whenever that may have occurred.

When calculating a Tier I, Tier A and Tier B Member’s retirement, the monthly benefit amount cannot exceed the monthly final compensation amount.

In addition to base pay, many pay categories count toward a Member’s final average compensation. Refer to the Earnings Categories chart for Tier I, Tier A and Tier B Members or the Earnings Categories chart for Tier C and Tier D Members [on the SDCERA website] for a list of included pay categories depending on your tier. Overtime and terminal pay (such as vacation cash out) are excluded when determining final average compensation.

If you became an SDCERA Member after July 1, 1996, federal or state law limits the amount of compensation that may be used to calculate your benefit. For 2021, the compensation limit for Tier I, Tier A and Tier B Members is $290,000, General Tier C and Tier D Members is $128,059 and Safety Tier C and Tier D Members is $153,671.

—

In closing, make the time to plan your financial future. Start off with the knowledge most people will need more than a pension in retirement. You can be as active or hands-off with your investments based on your life and investment choices. Research your options and utilize the resources at hand. A financial planner can share advice, describe your options, and help you move your assets based on your decisions and financial needs. Know the difference and benefits of both pre- and post-tax investments. Research investment options other than the stock market, such as real estate, cryptocurrency, and precious metals. Learn about life insurance options and get expert opinions on how to use them effectively throughout your career and into retirement. Good luck to all of you in your investment choices. It is always fun to see your assets grow and dream about the end goal: a long, happy, secure life.⭑